Dominic Rushe Bio

- Environment March 19, 2021

photo above: Axiom/Zuma

WN: Hope springs eternal. The article highlighted is hopeful!

excerpts:

This story was originally published by the Guardian and is reproduced here as part of the Climate Desk collaboration.

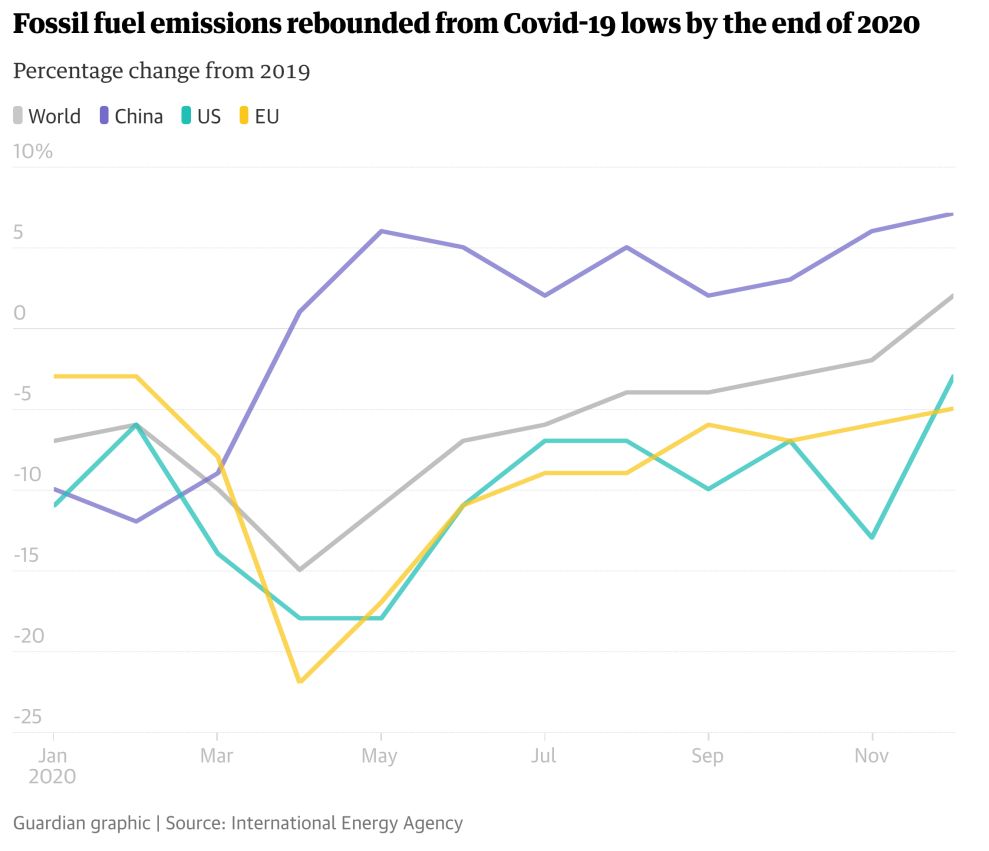

Wildfires burned nearly 10.4 million acres across the US last year. The most costly thunderstorm in US history caused $7.5 billion in damage across Illinois, Iowa, Nebraska and South Dakota. As the climate crisis swept the globe on a biblical scale it left in its wake a record number of billion-dollar disasters.

And yet out of these ashes has emerged an unlikely savior: Wall Street. After decades of backing polluters and opposing legislation to rein them in, finance says it’s going green.

…

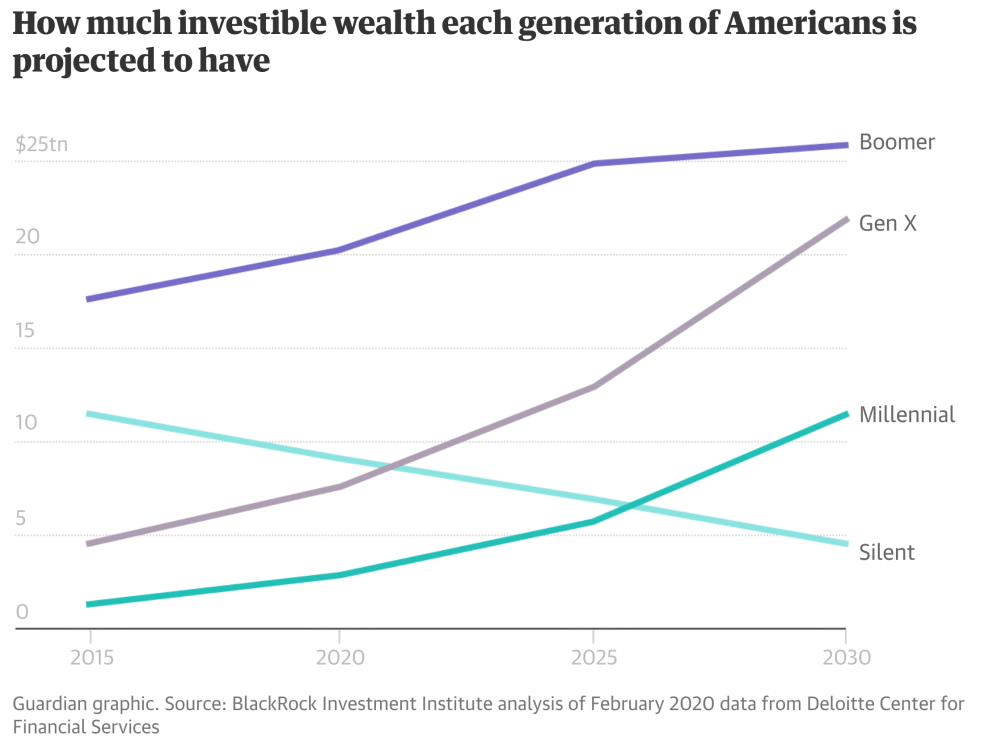

But, make no mistake, this is about money. Sustainability is “a new source of return across all asset classes” according to Jean Boivin, the head of the BlackRock Investment Institute. BlackRock’s green new deal isn’t so much about excluding bad actors or managing the risk of climate change as it is about “riding a wave that should be a source of return in itself.”

With Joe Biden in power after ousting Donald Trump, the climate denier in chief, trillions of dollars of investment could soon be earmarked for sustainable solutions.

…

But even environmentalists and longtime activists are—cautiously—optimistic about the direction the investment community is taking. After years of campaigning against corporate damage they see significant signs of progress, albeit with caveats.

Please click on: Wall Street and Climate Change